You’ve just been involved in an accident and the other driver’s at fault.

You want to know which option to take in order to maximize recovery for your damaged vehicle.

The first thing you’ll need to figure out is whose auto insurance provider to file a claim with.

Check your auto insurance policy for collision coverage. If you are paying the premium on collision coverage, you can make a claim on your own auto insurance policy after an accident.

After paying the deductible, your insurer will provided you with a selection of shops and locations in order to get the estimate for the damages and pay for your car repairs.

Your insurance company will then subrogate (ask for reimbursement) from the other driver’s insurer. Once the other company determines that their policyholder was at fault, they send payment to your insurance company and in return, refunds your deductible.

The process of determining liability, getting vehicle estimates, and repairs can take anywhere from several weeks or even months.

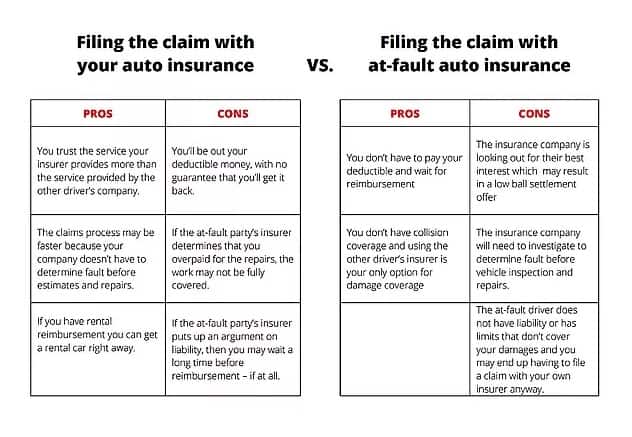

Here are the pros and cons of both scenarios:

Filing the claim with your auto insurance:

Pros – You trust the service your insurer provides more than the service provided by the other driver’s company. The claims process may be faster because your company doesn’t have to determine fault before estimates and repairs. If you have rental reimbursement you can get a rental car right away.

Cons – You’ll be out your deductible money, with no guarantee that you’ll get it back. If the at-fault party’s insurer determines that you overpaid for the repairs, the work may not be fully covered. If the at-fault party’s insurer puts up an argument on liability, then you may wait a long time before reimbursement – if at all.

Filing the claim with at-fault auto insurance

Pros – You don’t have to pay your deductible and wait for reimbursement. You don’t have collision coverage and using the other driver’s insurer is your only option for damage coverage

Cons – The insurance company is looking out for their best interest which may result in a low ball settlement offer. The insurance company will need to investigate to determine fault before vehicle inspection and repairs. The at-fault driver does not have liability or has limits that don’t cover your damages and you may end up having to file a claim with your own insurer anyway.

Whether you choose to seek help with repairs from your own insurance or the other driver’s insurer, you will only be covered up to the limits of the driver’s liability coverage.

If you were involved in an accident, let your insurance company know right away, regardless of which route you decide to take.

Please be aware that it is against Nevada Law for an insurance company to raise your rates after a claim related to an accident that wasn’t your fault NRS 687B.385. When your vehicle has been deemed a Total Loss it means that Vehicle damage exceeds 65% of the fair market value. N.R.S. § 487.790(1)(b).

2580 Sorrel St, Las Vegas, NV 89146

(702) 745-4700